Describe Uses of Security Market Indexes

The original purpose of indices was to. - Benchmark for evaluating performance of professional portfolio managers.

Stock Index Trading Terminology Stock Index Stock Market Investing Money

0 Complete 011 Steps.

. Gauges of Market Sentiment. F describe rebalancing and reconstitution of an index. 116 SAPP Academy 8 th Floor Nam A Bank building 54 Le Thanh.

Almost all benchmarks are indexes although not all indexes are benchmarks. A market index represents the performance of a specified security market market segment or asset class. Calculate and interpret the value price return and total return of an index.

Security market indices were first introduced as a simple measure to reflect the performance of the US. Describe indexes representing alternative investments. Calculation of price return and total return of an index.

K compare types of security market indexes. Stock market indices may be classified in different ways. Uses of security indices.

I am using your study notes and I know of at least 5 other friends of mine who used it and passed the exam last Dec. Benchmarking for fund managers. Describe the choices and issues in index construction and managementd.

J describe indexes representing alternative investments. STOCK-MARKET INDEXES 5 6. Describe a security market index.

Types of Stock Market Indices. For example to project future stock price movements technicians would plot and analyze price and volume changes for a stock market series like the DJIA. Compare types of security market indexes.

Since then security market indices have evolved into important multipurpose tools that help investors. MARKET EFFICIENCY The candidate should be able to. An indicator sign or measure of something.

Calculate and interpret the value price return and total return of an indexc. A price return index reflects only the prices of the constituent securities. Security Market Indices.

- Indicator of economic performance and investors. Describe rebalancing and reconstitution of an index. The constituent securities selected for inclusion in the security market index are intended to represent the target market.

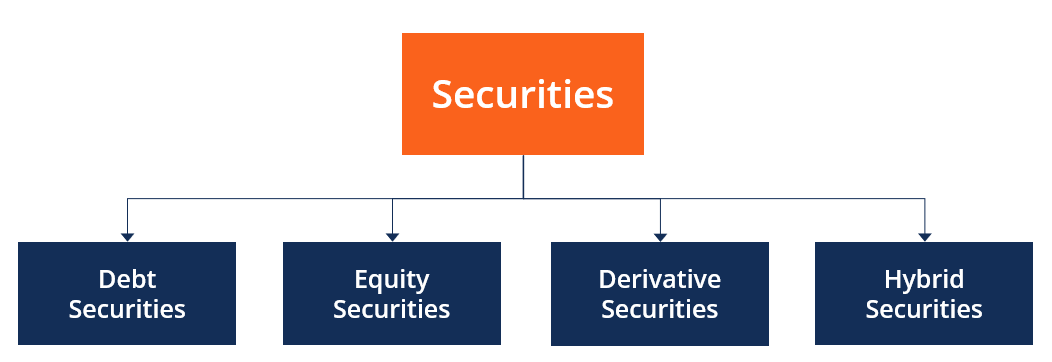

Indices are used as a benchmark against which an active fund managers performance can be measured. A security market index is a method to measure the growth of cost of a fixed of securities. A security market index represents a given security market market segment or asset class usually constructed as portfolios of marketable securities known as constituent securities.

To measure market rates of return in. 7 rows Security Market Index is a mathematical measure that shows the performance of a stock. Benchmark of manager performance an index can be used to evaluate the performance of an active manager 3.

Describe types of fixed-income indexes. A price return index. Measure of market return and risk in asset allocation it estimates the expected return and standard deviation of returns for various asset.

Q8 Compare types of security market indexes. A global or world stock market index such as the MSCI World or the SP Global 100 contains stocks from multiple regionsRegions can be defined geographically for example Asia Europe or by levels of income or industrialization for example frontier markets developed markets. H describe types of equity indexes.

Indexes help investors track performance and risk benchmark active managers and invest in broad markets at low costs. G describe uses of security market indexes. I describe types of fixed-income indexes.

A stock index or stock market index is a measurement of a section of the stock market. Calculate and analyze the value and return of an index given its weighting methodf. Reflection of market sentiment shows investor confidence in general 2.

Describe the several uses of security market indices. - Prediction of future share price movements using technical or ch artist analysis. For predicting future market movements by technicians.

Describe how benchmarks are used in return attribution and performance appraisal. Keep up your great work. Security market indexes are intended to measure the values of different target markets security markets market segments or asset classes.

Security market indices are used. It is a tool used by investors and financial managers to describe the market and to compare the return on specific investments. They are usually created as portfolios of individual securities which are referred to as the constituent securities of the index.

Describe a security market indexb. Describe the choices and issues in index construction and management. A security market index is used to represent the performance of an asset class security market or segment of a market.

But here the index selection should be in line with the managers investment style. Popular indexes include the Dow Jones SP 500 and Nasdaq. Describe types of equity indexes.

Describe uses of security market indexes. Applications of security market indices - Calculation of both factor in determining systematic risk. A market index is a hypothetical portfolio representing a segment of the financial market.

Sometimes an index is just an arithmetic common however generally its far a ratio wherein the cutting-edge index cost is divided by the index value of a. Describe a security market index. Compare the different weighting methods used in index construction.

Description of a security market index. Technicians believe past price changes can be used to predict future price movements. The primary uses of market indices are to 1 gauge market sentiments 2 serve as proxies for measuring returns and risk 3 serve as proxies for asset classes 4 benchmark active managers and 5 model portfolios for index funds and exchange-traded funds.

Indices were originally set to reflect the mood of investors. Describe a security market index. Calculate and interpret the value price return and total return of an index.

Describe indexes representing alternative investments. Up to 5 cash back Latin indic- index from indicare to indicate. D describe types of financial intermediaries and services that they provide d from FIN 462 at University of Oregon.

Describe the choices and issues in index construction and management. An index may have two versions. Compare the different weighting methods used in index constructione.

Used to represent the performance of an asset class security market or market segment - contain constituents - index return change in the indexs value over time. It is computed from the prices of selected stocks typically a weighted average.

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

Common Examples Of Marketable Securities

Comments

Post a Comment